Shop Karma: A shopping app that teaches teens how to save

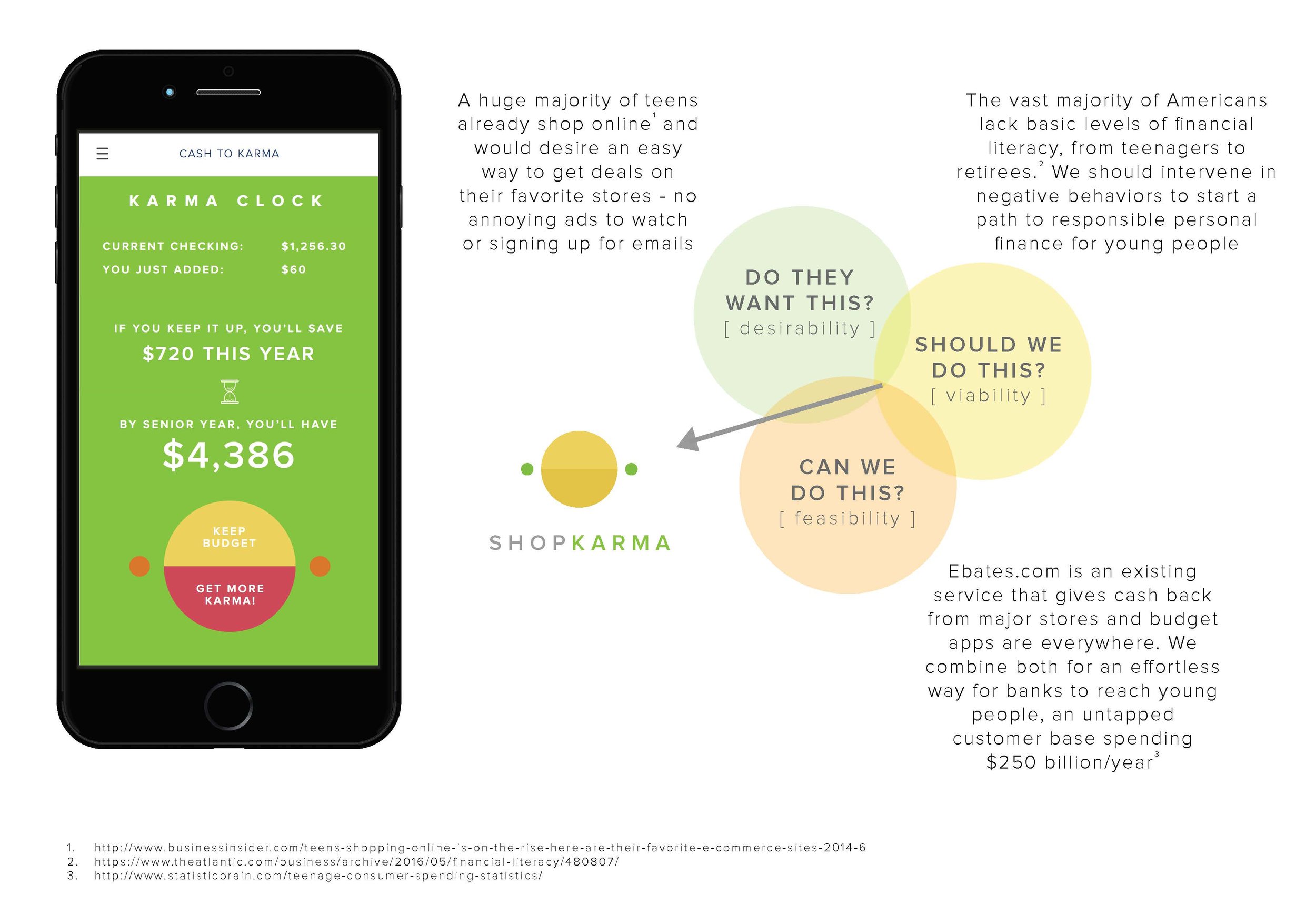

A shopping and budgeting app that uses the “cash-back” feature to encourage incremental savings that manipulate teens’ existing online shopping habits to form saving behavior.

Recognitions

Faculty Award for Practical, Faculty Award for Desirable, & Faculty Award for Want to See Real

Peer Award for Practical & Peer Award for Desirable

Team: Alethea Campbell, Experience Designer and Catherine Le, Product Designer

Keith Chen is a behavioral economist who found in his research “that languages without a concept for the future...correlate strongly with high savings rates.” Studying families on a variety of statistical controls, Chen explained:

“Now even after all of this granular level of control, do futureless language speakers seem to save more? Yes, futureless language speakers, even after this level of control, are 30 percent more likely to report having saved in any given year. Does this have cumulative effects? Yes, by the time they retire, futureless language speakers, holding constant their income, are going to retire with 25 percent more in savings.” (Source 1)

Chen compared English to Chinese speakers and highlighted that the lack of a future tense in Chinese resulted in a tendency to save money in the present - indicating an important cultural concept related to time and the future as having a major effect on saving behavior. In the United States, the “average household with any kind of debt owes $132,529, including mortgages.” (Source 2) Every year the cost of living rises at a steady rate and for the last nine years, the average household income has declined at a similar and consistent rate. It is extremely difficult to save money when all of your income is being used to support your family.

Though this is a systemic problem, the trouble is worsened by the lack of individual financial literacy that starts from youth into late adulthood. Economists have found that “forty-four percent of U.S. students surveyed had scores that placed them at the lowest levels of financial literacy” and “a survey of Americans over the age of 50 that asked three basic questions about compound interest, inflation, and risk diversification found that only a third answered all three questions correctly.” (Source 3) In other words, most families have no way of initiating a path to responsible personal finance.

How can we tap into current consumer behavior to introduce a small key behavior, that of thinking about basic financial concepts such as budgets and compound interest? One way to get there is by naturally introducing saving behavior into spending habits. Young people must become more aware of themselves, their future, their money, and their desires. A mindfulness method of ‘future self’ thinking is useful in this case:

“If something you do today doesn’t have a long-term benefit, then it’s probably not worthwhile to do it. If you can’t easily articulate how this action benefits you in the future—and by future, I mean months and years down the road—then it’s probably not an action worth taking.” (Source 5)

This cognitive process asks for one to be more mindful of the “choices you make today” because they will affect your future self’s choices. This method is very careful to not turn a negative eye towards eliminating behaviors, but an understanding of how you can form positive habits and eventually meet future goals in small increments.

Saving money is no doubt painful, especially if you are a teenager getting ready to go to college. The average teenager comes from a family with major debt and will most likely need to take out loans to attend college. In 2016, 70% of students graduated college with an average student loan debt of $37,172. (Source 7) How can we get young people to start thinking about and saving for important future investments?

We already know that teens do not have good spending habits. Each year, teenagers as a group are paying more than $250 billion 13 for desirable items that many consider unnecessary. The most popular items are clothing, food, entertainment, jewelry, and cars. They do not just love shopping but are also savvy shoppers; they are rarely invested in any marketing campaigns and are always looking for ways to save. (Source 4) For example, T.J. Maxx is a top ten retailer because it holds many luxury brands at a discount. Importantly, their preference is to shop online, specifically at Amazon. Among older teens, those who are 15-17 years-old make an average annual wage of just over $4,900, and 12-14-year-olds are making $2,700 annually. 9 If all of their income were saved over 6 years - starting from middle school until high school graduation - that would be approximately $22,800, an amount that helps them take care of later debt. Why not take their existing spending behavior to nudge them towards building habits of budgeting and saving - building karma by controlling their present behavior for future rewards?

Our app is called ShopKarma (SK), a shopping and budgeting app that uses the “cash-back” feature to encourage incremental savings that manipulate teens’ existing online shopping habits to form saving behavior. Since teens are already overspending on online shopping, an app that allows them to save money on each purchase is desirable. Ebates.com is an existing service that SK could partner with to form a viable business in which retailers are incentivized by more promotion.

SK’s interface is similar to Venmo in having a social sharing feature and ability to hold a balance to later deposit into your bank account. SK would feature stores available through Ebates and at the end of each month, users can deposit the balance into a savings account. SK would partner with banks to match this cashback amount by 1% if you save up to $100 a month - users can add what’s left over from their “fun budget” to meet this requirement and save more money.

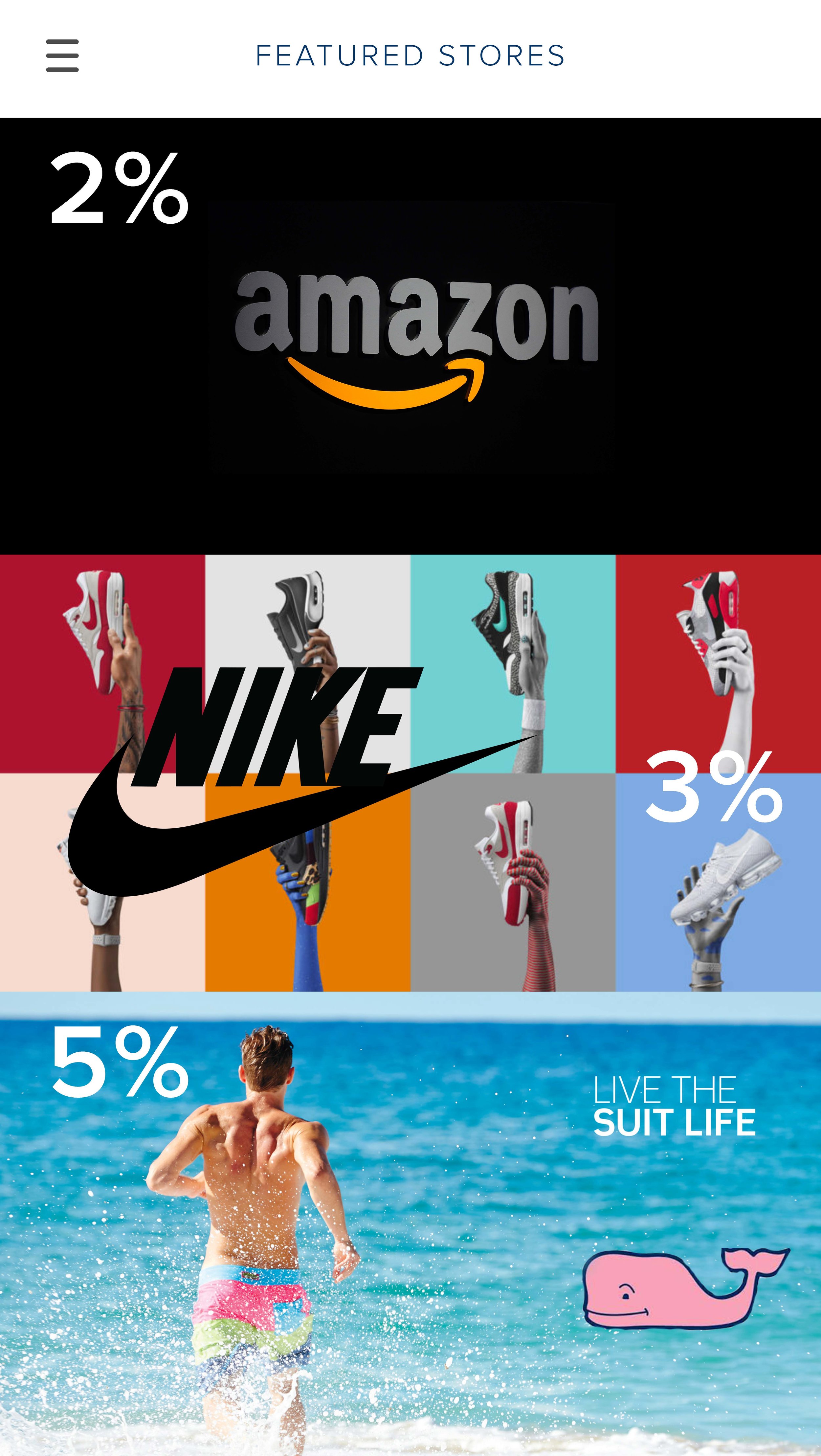

The SK algorithm would work similarly to both Instagram and Spotify. Those who used the app more would become a more desirable user and receive better rewards, and featured stores would be chosen in a way comparable to Spotify’s music choice suggestion based on purchase profile.

Taste profiles created to select featured stores.

At the end of every month, each user would be provided a graph to see what their savings would become after benchmarks (e.g. high school/college graduation), a number often used in the ‘future self’ thinking model. This model would teach users how to limit spending by thinking about budgets, compound interest, and savings goal without financial jargon or difficult habit forming. This service takes away the need to remember to save; it hooks users with the desirable reward of saving gradually for large end gains by nudging them naturally. Saving can begin as early as age thirteen and young people can become more mindful of saving if we provide an intervention - a positive change in a negative routine of overspending that hopefully establishes basic financial literacy and a habit of saving.

Sources

- https://www.ted.com/talks/keith_chen_could_your_language_affect_your_ability_to_save_money/transcript?language=en

- https://www.nerdwallet.com/blog/average-credit-card-debt-household/

- https://www.theatlantic.com/business/archive/2016/05/financial-literacy/480807

- http://teens.lovetoknow.com/Teen_Consumer_Spending_Habits

- http://lifehacker.com/three-key-principles-of-future-self-thinking-1792343365

- http://www.usnews.com/education/best-colleges/paying-for-college/slideshows/10-student-loan-facts-college-grads-need-to-know

- http://www.businessinsider.com/teens-shopping-online-is-on-the-rise-here-are-their-favorite-e-commerce-sites-2014-6

- https://crowdfavorite.com/the-value-of-balancing-desirability-feasibility-and-viability/

- https://www.creditdonkey.com/teenage-consumer-spending-statistic.html

- http://www.lifehack.org/articles/money/25-apps-that-will-save-you-lots-money.html

- http://www.businessinsider.com/how-teens-are-spending-money-2014-2014-10

- http://www.businessinsider.com/how-teens-are-spending-money-2015-4

- http://www.statisticbrain.com/teenage-consumer-spending-statistics/

Course: Harvard University, Design Survivor, Designing for Desirability.

*Please note, the following challenge was a short term design experiment.